Mayan calendar said the world should be ended 6am this morning. I think it is. The old world is gone. We are in a brand new world now. It's just you don't feel it. I think I rescue the whole world all by myself. You know I am superman / batman kind. :D

For those who don't use ES, lucky you. SPX currently is at 1430, -5 from yesterday's close. However, ES, the futures of SPX dip to 1391 last night, a 1% drop on the political combat.

I am on my mission to rescue the US now. I will solve the fiscal problem.

Here is the bullish Gartley that is going to protect us for now.

Friday, December 21, 2012

Thursday, December 20, 2012

world end? another waiting mode

The world didn't end according to Kathy Lien who is in NZ. The local time there is 3am 12/21/2012.

Yesterday I laid out my support line at 1430. So far it holds, but we are still in questionable zone of 1430-36. Here is the chart update.

I saw people shorting the market then covered after the eco news. Philly Fed at 8.1!! Existing home sales +5.9%.

What's next? I don't know. Let's just hold and hope.

ADD:

This is the interview on Santa Stock Surge. Bespoke's Paul Hickey appeared on CNBC's Street Signs today to discuss the Santa Claus Rally.

Some key points:

- santa rally starts 21 to year end.

- 12/30 has been the best day with 0.51% gain on average from 1928 to 2011

- In the ten days from 12/21 through year end, the S&P 500 has averaged gains on nine out of ten days for an average total gain of 1.82%.

Today ES closed at 1440.75.With 1.82% extra gain, it will end up at 1467 which is a very close to the 1468 yearly top. Does this mean we are not going any higher or it will be a double top pattern? I don't know. Paul mentioned another important data that historically Dec gain is about 2.1-2.2%. We already up about 2% as of today. Will we see a 4% month or just flat for the rest of the year? I have plans for both scenario. Let's wait and see.

Yesterday I laid out my support line at 1430. So far it holds, but we are still in questionable zone of 1430-36. Here is the chart update.

I saw people shorting the market then covered after the eco news. Philly Fed at 8.1!! Existing home sales +5.9%.

What's next? I don't know. Let's just hold and hope.

ADD:

This is the interview on Santa Stock Surge. Bespoke's Paul Hickey appeared on CNBC's Street Signs today to discuss the Santa Claus Rally.

Some key points:

- santa rally starts 21 to year end.

- 12/30 has been the best day with 0.51% gain on average from 1928 to 2011

- In the ten days from 12/21 through year end, the S&P 500 has averaged gains on nine out of ten days for an average total gain of 1.82%.

Today ES closed at 1440.75.With 1.82% extra gain, it will end up at 1467 which is a very close to the 1468 yearly top. Does this mean we are not going any higher or it will be a double top pattern? I don't know. Paul mentioned another important data that historically Dec gain is about 2.1-2.2%. We already up about 2% as of today. Will we see a 4% month or just flat for the rest of the year? I have plans for both scenario. Let's wait and see.

Wednesday, December 19, 2012

I think it is still uptrend. Levels to watch ES 1436-1430

Dow and S&P 500 really starting to fade after the crazy yesterday. S&P 500 has now given up more than half of its gain from yesterday. I am guessing it is still uptrend, but I want to watch 1436 and 1430 levels for safety. If 1430 cannot hold, I will stop myself out.

I will be on vacation next week. As usual, I don't want to keep positions open.

ADD:

I saw the following charts from the corner.

Even though we share very similar view on couple stocks, I have to tell Serge, his taste of woman is not so great. :D

ADD again.

Well this one gets better:

I will be on vacation next week. As usual, I don't want to keep positions open.

ADD:

I saw the following charts from the corner.

Even though we share very similar view on couple stocks, I have to tell Serge, his taste of woman is not so great. :D

ADD again.

Well this one gets better:

Friday, December 14, 2012

Gangnam Style - Certain Things to avoid

Here is news on Gangnam Style Dance.

In order to prove I am not middle-aged yet, I think I should try the list above. I tried Gangnam style dance for about 2 minutes and I feel dizzy. After this news I decide to quit that crap, forever. Me no sporty-car type, but rather off-road kind. I don't want to change my style, at least for now. I am losing hair. Still better than my friend COB, but I don't think I want to do hair in a can. The only left-over is to date an illegal hottie. I am on my way to NYC. Let's see if I can do that. :D

The market is dancing in a way hard to predict. FED meeting is making it worse. I bot some options to protect my position and disclosed in last post. As planned I closed that hedge yesterday at sub-1420 level. Now we are all the same. Holding long positions, naked, and watching market falling. This is another I don't know moment. I guess and I hope 1407 will hold.

(Starting from now, I am using Mar 2013 ES, which is about 5 points below SPX.)

There are certain things that middle-aged men should probably steer clear of: buying a flashy sports car, dating a barely-legal hottie, succumbing to the allure of hair-in-a-can.

However, this week, after the death of a British dad, experts now warn that dancing "Gangnam Style" may be yet another middle age no-no.

As the Sun notes, 46-year-old Eamonn Kilbride was performing the energetic dance -- made wildly famous by Korean pop star Psy -- at his office Christmas party over the weekend when he suddenly collapsed and died.

In order to prove I am not middle-aged yet, I think I should try the list above. I tried Gangnam style dance for about 2 minutes and I feel dizzy. After this news I decide to quit that crap, forever. Me no sporty-car type, but rather off-road kind. I don't want to change my style, at least for now. I am losing hair. Still better than my friend COB, but I don't think I want to do hair in a can. The only left-over is to date an illegal hottie. I am on my way to NYC. Let's see if I can do that. :D

The market is dancing in a way hard to predict. FED meeting is making it worse. I bot some options to protect my position and disclosed in last post. As planned I closed that hedge yesterday at sub-1420 level. Now we are all the same. Holding long positions, naked, and watching market falling. This is another I don't know moment. I guess and I hope 1407 will hold.

(Starting from now, I am using Mar 2013 ES, which is about 5 points below SPX.)

Tuesday, December 11, 2012

Quick update

I was looking for a dip to 1400 then a rally to 1430 in my monthly LMP update. So far I got both of them. Not sure what's next. I feel a pull back to 1420 area then for next move. I am using derivatives to play that. It is small, so long term investors don't have to take that action.

Monday, December 3, 2012

Monday morning news reading

I read this article from the big picture.

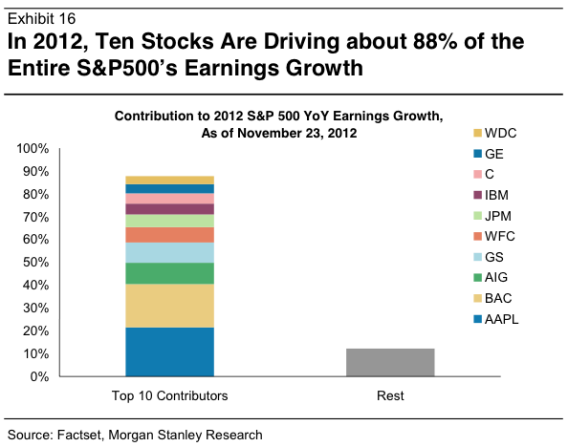

4 Companies Provided Half of SPX 2012 Earnings Growth

It notes that nearly 90% of this year’s earnings growth of the S&P 500 companies can be traced to 2% or 10 companies.Who are they? All those too big to fall names. Yeah.

There seems to be two industries, finance and technology. It is even more concentrated than the chart suggests. Four

companies–three financial services (AIG, Goldman and Bank of America)

and one technology firm (Apple) provided over half of the earnings

growth of the S&P 500.

If the next door papamama grocery grows slower than its banker, what does it suggest? Go figure.

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

December Low Indicator

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

Sunday, December 2, 2012

Low Maintenance Portfolio Update Dec 2012

No big change in view. No big deal, I think.

For the new month, I have everything on buy side.

What's different this month is I am holding 20% of SPY (It's the ETF for SP 500. It is 1/10 of SPX plus dividends) at 136 for 2 weeks now (refer to my 3-push pattern posts). This month, SPX actually dip below the MA then came back to form a hammer shape. To add at the signal line is not a violation to the LMP methodology.

I think it may face some short-term pressure. I am managing the risk by using some simple derivative strategy. I hope it could go up a little bit more, let's say 143ish.

My plan is holding equity for Santa, then close out before Christmas.

For the new month, I have everything on buy side.

The 5 IVY portfolio components are

- SP 500 (Risk ON)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk ON) / USD (Risk ON)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON)/ GLD (Risk ON)

- US Dollars (Risk off)

What's different this month is I am holding 20% of SPY (It's the ETF for SP 500. It is 1/10 of SPX plus dividends) at 136 for 2 weeks now (refer to my 3-push pattern posts). This month, SPX actually dip below the MA then came back to form a hammer shape. To add at the signal line is not a violation to the LMP methodology.

I think it may face some short-term pressure. I am managing the risk by using some simple derivative strategy. I hope it could go up a little bit more, let's say 143ish.

My plan is holding equity for Santa, then close out before Christmas.

Thursday, November 29, 2012

ECRI the leading indicator

Do Economic Indicators Show U.S. in Recession?

On Nov. 29, 2012, ECRL co-founder and COO Lakshman Achuthan displays economic indicators he believes to show that the United States in currently in recession. He speaks on Bloomberg Television's "Bloomberg Surveillance."

It is very self-explanatory. There are couple macro indicators discussed and showed here. Lakshman said recession started in July. Jobs is the only one not agreeing, the reason is contraction of labor force. He also mentioned in 3 of 7 the last recessions jobs increased into the recession.

When people asked other indicators, he said GDP is only quarterly, (which may not be up to date, and may be too slow to spot trend change) and stock market and risk assets give signals, but the signals are distorted here.

On Nov. 29, 2012, ECRL co-founder and COO Lakshman Achuthan displays economic indicators he believes to show that the United States in currently in recession. He speaks on Bloomberg Television's "Bloomberg Surveillance."

It is very self-explanatory. There are couple macro indicators discussed and showed here. Lakshman said recession started in July. Jobs is the only one not agreeing, the reason is contraction of labor force. He also mentioned in 3 of 7 the last recessions jobs increased into the recession.

When people asked other indicators, he said GDP is only quarterly, (which may not be up to date, and may be too slow to spot trend change) and stock market and risk assets give signals, but the signals are distorted here.

Tuesday, November 27, 2012

Monday, November 19, 2012

Update 11/19/2012

This market is getting harder to trade. Currently I break the movement down this way.

ES (the SPX futures) retreated to 1360 to reflect uncertainty about Obama's second term. Then the Israel news pushed 20 points further to 1340. Friday afternoon we got good news from the congress. SPX soar 20 points. Then over the weekend middle east cooled down. So now we are back at ES 1380 area.

1380-85 is a good resistance area, defined by last drop. There is a pretty reliable 1on1 bearish pattern on ES hourly. Also 200 day MA is at SPX 1382. These things are going to hold the market for a while. Then we can figure out which direction the market wants to go.

Add chart:

ES (the SPX futures) retreated to 1360 to reflect uncertainty about Obama's second term. Then the Israel news pushed 20 points further to 1340. Friday afternoon we got good news from the congress. SPX soar 20 points. Then over the weekend middle east cooled down. So now we are back at ES 1380 area.

1380-85 is a good resistance area, defined by last drop. There is a pretty reliable 1on1 bearish pattern on ES hourly. Also 200 day MA is at SPX 1382. These things are going to hold the market for a while. Then we can figure out which direction the market wants to go.

Add chart:

Sunday, November 11, 2012

3 push pattern

To clarify based on some questions I received, unless specified, all my point levels are based on ES, which is the tick of futures of S&P 500 (the tick is SPX). There are bunch of materials on the relationship between cash index and futures. The difference is mainly due to dividends and time value.

Here is my simplified explanation. ES futures are quarterly. At the beginning of the quarter, the current ES is about 5 points lower than SPX. During the quarter, the difference gets smaller. At the futures expiration, they equal to each other.

I guess I get what I am asking for. In last post, I showed my setup of the 3 push pattern and mentioned my target of ES 1365-70 ares.

Friday morning, the chart looked like this.

I was in a hurry. I didn't have chance to mark my chart, because I was buying the dip. I told 1 friend

I was not far off again. I exit ES longs at 1382.5 around 11:00 and happily took the rest of the day off. ES actually went to 1388, slightly higher than my mid-1380 target then head down to 1372.

My chart above actually tells my trading plan. I still have some calls. I think the recovery will take a while. I guess ES may test 1400 to confirm the break-down. That could be a good chance to exit long and go short again.

Here is my simplified explanation. ES futures are quarterly. At the beginning of the quarter, the current ES is about 5 points lower than SPX. During the quarter, the difference gets smaller. At the futures expiration, they equal to each other.

I guess I get what I am asking for. In last post, I showed my setup of the 3 push pattern and mentioned my target of ES 1365-70 ares.

Friday morning, the chart looked like this.

I was in a hurry. I didn't have chance to mark my chart, because I was buying the dip. I told 1 friend

I was not far off again. I exit ES longs at 1382.5 around 11:00 and happily took the rest of the day off. ES actually went to 1388, slightly higher than my mid-1380 target then head down to 1372.

My chart above actually tells my trading plan. I still have some calls. I think the recovery will take a while. I guess ES may test 1400 to confirm the break-down. That could be a good chance to exit long and go short again.

Thursday, November 8, 2012

(nothing) lots to say - updated

As I said the street favors Romney. They didn't get their candy this time. As usual they put on the drama now. Somebody is calling bottom. I am conservative this time. I think the battle around neckline SPX 1400 is far from over. Volatility is heading up. I expect it to go even higher.

(1 of my readers don't trade equity. I guess he can handle Bond well. :D Me nice enough to translate my expectation into plain English:

This means I guess index won't move too much, but will be very volatile like yesterday. Intra-day range will be bigger.)

It's the best time for trading. If you don't like trade, then think about reduce your exposure and just wait on the side.

(to add charts)

This is not a typical flag, as the correction took too long and too flat. However, it is a rectangle correction. The next movement is always powerful. If I have to guess the points, I am targeting ES 1365-1370 area, which is 1370ish SPX.

I discussed weekly RSI with a friend HD. I believe it is not oversold yet. We still have room to go down.

Pattern-wise, this is the 3 push pattern I am expecting. I think there will be 3 pushes to the down side, but it does not mean it could be only 3. Anyway my bias is to the down side.

Add:

My friend CR sent me this link. It is on the Hindenburg Omen I discussed a while ago. Th author says Hindenburg Omen is about to issue the first signal. What to expect?

Here's how it works:

1. Once an initial signal has been issued, a second signal (the 'confirming signal') must be attained within 36 days [Dr. Robert McHugh]. That confirming signal could happen the next day or the next week.

2. When the "confirmed HO signal" has been issued it is valid for 30 trading days [Jim Meikka, creator of the HO].

3. Once an official HO signal has been issued in accordance with the two rules above, the odds of various corrections occurring are as follows, according to the records of Dr. Robert McHugh. These are not predictions nor speculative guesswork. They are a cast in stone record of what has happened in the past.

here's how it breaks down based on past performance:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

Here comes Ron Walker and his famous BPI

(1 of my readers don't trade equity. I guess he can handle Bond well. :D Me nice enough to translate my expectation into plain English:

This means I guess index won't move too much, but will be very volatile like yesterday. Intra-day range will be bigger.)

It's the best time for trading. If you don't like trade, then think about reduce your exposure and just wait on the side.

(to add charts)

This is not a typical flag, as the correction took too long and too flat. However, it is a rectangle correction. The next movement is always powerful. If I have to guess the points, I am targeting ES 1365-1370 area, which is 1370ish SPX.

I discussed weekly RSI with a friend HD. I believe it is not oversold yet. We still have room to go down.

Pattern-wise, this is the 3 push pattern I am expecting. I think there will be 3 pushes to the down side, but it does not mean it could be only 3. Anyway my bias is to the down side.

Add:

My friend CR sent me this link. It is on the Hindenburg Omen I discussed a while ago. Th author says Hindenburg Omen is about to issue the first signal. What to expect?

Here's how it works:

1. Once an initial signal has been issued, a second signal (the 'confirming signal') must be attained within 36 days [Dr. Robert McHugh]. That confirming signal could happen the next day or the next week.

2. When the "confirmed HO signal" has been issued it is valid for 30 trading days [Jim Meikka, creator of the HO].

3. Once an official HO signal has been issued in accordance with the two rules above, the odds of various corrections occurring are as follows, according to the records of Dr. Robert McHugh. These are not predictions nor speculative guesswork. They are a cast in stone record of what has happened in the past.

here's how it breaks down based on past performance:

Major Crash - 27% probability

Selling panic of at least 10-15% - 39% probability

Sharp decline of at least 8-10% - 54% probability

Meaningful decline of at least 5-8% - 77% probability

Mild decline of at least 2-5% - 92% probability

The HO signal is an outright miss - 7.7% probability (one out of 13 times)

Here comes Ron Walker and his famous BPI

Wednesday, October 31, 2012

10/30 Waiting Mode

It is hard to judge what's going on at this moment. My reading on 10/22 is not a good one. I thought it was a double bottom which may result in a rebound. Unfortunately, market went down, with no obvious reason. Now we have 2 scenario.

1) The Pattern I pointed out in 10/11 post is still in play. SPX may find support in sub-1400 level, then rebound to 1450 level 1 more time.

2) The pattern was completed on 10/12 because the rebound to SPX 1465 then reverse down was too big to be considered as a sub-movement.

I think the bottom line is we are bottoming. Sub-1400 level is a much better support. As I pointed out at Dino's, if no more selling pressure, ES will do some mild recovery since Friday afternoon. Actually, ES made another double bottom at 1393-1394 level during Monday global session, which roughly equals to 1398-1399 SPX.

I expect a revisit of the overhead trend line which is declining, then we crash into the year end.

1) The Pattern I pointed out in 10/11 post is still in play. SPX may find support in sub-1400 level, then rebound to 1450 level 1 more time.

2) The pattern was completed on 10/12 because the rebound to SPX 1465 then reverse down was too big to be considered as a sub-movement.

I think the bottom line is we are bottoming. Sub-1400 level is a much better support. As I pointed out at Dino's, if no more selling pressure, ES will do some mild recovery since Friday afternoon. Actually, ES made another double bottom at 1393-1394 level during Monday global session, which roughly equals to 1398-1399 SPX.

I expect a revisit of the overhead trend line which is declining, then we crash into the year end.

Tuesday, October 23, 2012

Monday, October 22, 2012

Market Reading 10/22/2012

Did I say I m going to make a new post? Me getting lazy

recently. As I mentioned in my intraday charts, I see somebody defending the

1416 low.

If you study the volume profile on the right and the better volume on the bottom, you will see lots of buying climax up.

So far I read the tape as retest then regain support at ES 1416.

On SPX it is slightly different, because last 1416 was after regular trading

hour. On that day, SPX low was at 1425 then closed at 1428. Today we touched

1420 then rebound to 1433. I don’t know how to interpret the difference. I tend

to ignore SPX which is the cash index, but follow ES which is the SPX futures

traded clock around.

It is an Adam-Adam double bottom pattern. I expect a rally in the next couple days. My plan is to trade to the trend line. I add longs when I cut the chart above.

How high can SPX go? According

to Bulkowski’s book, calculated target is around 1490ish. My own measurement is

1470s. The reason is the last spike is too big, unreasonably big. Can it go higher? Can it take out the 1475 peak? Yes maybe. In this dumb bull market, anything could happen. I still feel we are close to the end of the dumb rally from 2009. End of 2012 will be messy even if it is not the end of the world. :D

Monday, October 15, 2012

couple interesting charts

all from internet.

According to this chart, equity used to peak in late September during election year. so far we are not far off this year. Let's how it goes this time.

Below is the daily chart for Nasdaq which usually is a leading indicator. It is pretty self-explanatory.

According to this chart, equity used to peak in late September during election year. so far we are not far off this year. Let's how it goes this time.

Below is the daily chart for Nasdaq which usually is a leading indicator. It is pretty self-explanatory.

Thursday, October 11, 2012

me is back

I am back into normal which is not as exciting as I expect. :D

As I said 100 times, the market is full of government manipulation. I don't see any real improvement worldwide. THEY are busy painting here, covering there. Between jobs, the market may drop a little. Here is a moment.

On weekly scale, the rally we are currently in started last Oct. We experienced 2 major corrections. Both of them are close to 61.8%. If we correct 61.8% this time, it may be in 1350s.

Daily chart is in trouble as well. The current support is around 1420-1430 area, defined by last high of 1420 and last retracement of 1430. Fork and channel and MA all park at the same area.

Here is my projection based on hourly chart. We will lose the support and test sub 1400 level which is the real thing. Then in early Nov, they will push it higher to maybe 1450s. After all the hyper is gone, it's time to do gravity check.

As I said 100 times, the market is full of government manipulation. I don't see any real improvement worldwide. THEY are busy painting here, covering there. Between jobs, the market may drop a little. Here is a moment.

On weekly scale, the rally we are currently in started last Oct. We experienced 2 major corrections. Both of them are close to 61.8%. If we correct 61.8% this time, it may be in 1350s.

Daily chart is in trouble as well. The current support is around 1420-1430 area, defined by last high of 1420 and last retracement of 1430. Fork and channel and MA all park at the same area.

Here is my projection based on hourly chart. We will lose the support and test sub 1400 level which is the real thing. Then in early Nov, they will push it higher to maybe 1450s. After all the hyper is gone, it's time to do gravity check.

Friday, August 3, 2012

This market is full of Gov manipulation

It may extend a little bit, but I will let it go.

Eurogroup to meet on Sept 3 to discuss Greece and ... SPAIN.

Me not brave enough to yell the king is naked.

Eurogroup to meet on Sept 3 to discuss Greece and ... SPAIN.

Me not brave enough to yell the king is naked.

Tuesday, July 31, 2012

Reading the market.

(quote online)

CropCircles Murrey Math char. I believe this author is a friend of TH Murrey.

CropCircles says:

Still short the S&P from 1421.88 "THE TOP", took profits from the not getting greedy line. Hit it again at 1374.81, 1375, and again today on the close. Could consolidate here for about a week and a half which is preferd in order to trap a few bulls that see it as an opportunity to get on board, only to be taken to out as the market fails to hold 1375. Those that are long are in for sure and holding, looking for new highs. Still short The Greatest Ponzi in the Sept. from 151.15 and 152.28. Still long gold from 1562.50

Here is my chart. I have 0 exposure at this moment. I will be on vacation starting next week. GLTA.

Finally we get to see a bit of red. At least punters like us, who have missed this entire advance from the Draghi low can go and get ourselves a cup of coffee and ponder our next move! The way the DAX traded late in the session yesterday, it looked like the market was beginning to build in expectations of a rate cut, a significant EFSF programme for Spain, a reactivation of the SMP, an ESM banking license and an LTRO as an added bonus....all this Thursday alone. If ever there's been a case of hope built into an event (the ECB meeting), then this one has to rank right up there amongst the all-timers. So far, the market loves whatever it is smoking. But so did all us cycling lovers before the most hyped up Road Race finish that was meant to bring Gold for Team Wiggins/Cavendish last Sat. We know what happened. Expectations are a bad mantra to follow. Have none and life's cool. Things are on edge here, as today's Daily will go onto prove. We choose the European 600 Index chart to present the picture that should now be firmly etched in the minds of every market participant. This picture takes a more cultured medium-term view, which should make for a welcome change as many of us have been slavishly slapped around by the tape like little kids since late last week. Since the Index topped in early 2011, a powerful downtrend line has been operative. Critically, price has now almost approached this downtrend line. Simultaneously, an uptrend line has caught three solid touch-points since the late summer low of last year. This makes for an extremely juicy set-up. One side of the market is going to give way...and soon.

Three outcomes are now possible. Under Scenario A, the market

blasts through the downtrend line and the Central Bankers deliver a Game

Changer. Unfortunately, as we now know, large European corporations are

not able to deliver clear revenue/earnings guidance because of European

macro and Chinese slowdown issues.

De facto, the onus is now on the Central Bankers. Bulls need to hope and

pray here that Draghi has not bitten off more than he can chew. The

good thing about Scenario A is that we will know pretty soon. Can we

commit to this scenario at this juncture? We have no edge and it would

be a pure guess.

Under Scenario A, we will get killed in our book.

Next is Scenario B. Under this scenario, the market kisses the downtrend

line. It takes resistance and turns back down. That's still fine for

the bullish case as long as any pullback stays above the 200 DMA. A kiss

off the trend line and then an upside breakout that stays the course

for the rest of the year as the market continues to climb the proverbial

Wall of Worry....would make for an eminently plausible scenario.

Under Scenario B, we have time to position for the rally.

Finally, we have Scenario C. We call this the "Monster Mess with the

Head" scenario - and the one that kills everyone. Here, the market takes

out the downtrend line and accelerates higher in a fast move, only to

rip the guts out of all remaining bears. We close all our shorts at the

top and in a state of panic, get the book long up the ying yang.

CNBC goes nuts with pundits calling for 1600 on the SPX by year-end.

It's too much to bear missing the rally. We make the bull call and then,

as is the norm with headline driven markets, the market turns sharply

lower and gives back everything it has made faster than you can say Koji

Yamamoro (Japan's top gymnast who finished yesterday with a back

somersault but landed on his face and knees and had to unfortunately be

helped off hopping on his right foot).

Having neatly laid out the three Scenarios, we're left to grade their

probabilities now.

Our guess would be 30:30:40 for A:B:C.

If A happens, we are left behind and scrambling. Draghi sends all the

bears to hell.

B would be a decent outcome and one we could get on top off.

C would be the nightmare where we get long at the wrong level and get

whipsawed. Well, if do get whipsawed, so be it. Deydun Alpha had a

decent track record for short-selling and we'll back ourselves to catch a

potential fast reversal.

Meanwhile, note that the Trannies have yet to break free from recent

highs as does the SOX, Russell-2000 and EEM. And China has yet to catch a

bid. New low for 2012 for SHCOMP today suggests they need a printing

press soon. Winning Golds at the Olympics ain't enough to move their

markets into the bull zone.

CropCircles Murrey Math char. I believe this author is a friend of TH Murrey.

CropCircles says:

Still short the S&P from 1421.88 "THE TOP", took profits from the not getting greedy line. Hit it again at 1374.81, 1375, and again today on the close. Could consolidate here for about a week and a half which is preferd in order to trap a few bulls that see it as an opportunity to get on board, only to be taken to out as the market fails to hold 1375. Those that are long are in for sure and holding, looking for new highs. Still short The Greatest Ponzi in the Sept. from 151.15 and 152.28. Still long gold from 1562.50

Here is my chart. I have 0 exposure at this moment. I will be on vacation starting next week. GLTA.

Friday, July 27, 2012

Gov Manipulation

This market is full of gov manipulation. It is hard to trade recently. Large movements are all in the European hours. Not too much left for US market. Will ECB buy troublesome bonds? Yes I believe so, and the market believes so too.

Tuesday, July 24, 2012

Sad news: Flooding in Beijing, 37 killed

Hong Kong (CNN) -- What has been described as the

"heaviest rain in six decades" left at least 37 people dead and raised

criticism about Beijing's infrastructure and the government's response

to disasters.

Do you know how to get out your car in flood?

Here is a link you may want to check.

I highly recommend this product.

Remember the drill:

1. Go to Amazon using the following link. (YES! ABSOLUTELY)

http://www.amazon.com/?_encoding=UTF8&tag=memyselfand0b-20

2. Search for

ResQMe Car Escape Tool

The torrential downpour

lasted 10 hours over the weekend, producing gusty winds and a tornado in

one suburb, according to local media.

The deluge was the

largest since 1951, when the state weather record was established,

according to Beijing Morning Post, bringing about 6.7 inches of rain in

some parts of Beijing, and as much as 18 inches in the suburban Fangshan

district.

Of the 37 deaths in

Beijing, 25 people drowned, reported Xinhua. Another six were killed in

collapsing houses, five were electrocuted, and one was hit by lightning,

the agency reported, citing the municipal government.

The flooding killed 95

people and 45 were reported missing in 17 provincial areas of China,

Xinhua reported. Nearly 6.23 million people were affected by the heavy

rains, which started July 20.

Do you know how to get out your car in flood?

Here is a link you may want to check.

I highly recommend this product.

Remember the drill:

1. Go to Amazon using the following link. (YES! ABSOLUTELY)

http://www.amazon.com/?_encoding=UTF8&tag=memyselfand0b-20

2. Search for

ResQMe Car Escape Tool

Thursday, July 19, 2012

I think we may see a correction

not sure how bad it is. i think 1350s at least

here is a very nice chart made by MktAnthropology

I love the analogy.

here is a very nice chart made by MktAnthropology

I love the analogy.

Thursday, July 12, 2012

Market Reading - hold off again

I previously planned to go back in at 1320, as part of my risk mitigation with my exit before 7/4. I think it is bottoming, It could be 1 more leg down to

draw a double bottom, but the low is very near if not printed already imo. Unless we get some triggering event, this week is done.

I decide to hold off for now. I will think of the next step during the weekend.

Update of the AUD USD chart.

I decide to hold off for now. I will think of the next step during the weekend.

Update of the AUD USD chart.

Tuesday, July 10, 2012

Sunday, July 8, 2012

Market Reading

Couple charts I am looking at.

here is a chart from chartrambling on Friday.

This is a chart I got from somebody.

This is my chart with tweaked forks.We will see if the trend line holds next week.

here is a chart from chartrambling on Friday.

This is a chart I got from somebody.

Friday, July 6, 2012

News from this morning

Stocks retreated on Wall Street early Friday after the U.S. government reported that only 80,000 jobs were created in June, the third straight month of weak hiring.

The Dow Jones industrial average dropped 134 points to 12,762 in the first hour of trading Friday. The loss wiped out the Dow's gain for the week.

http://finance.yahoo.com/news/us-stocks-drop-weak-june-134701709.html

Conservatism and consistency get paid off.

ZH said,

The worst news is that the number is not bad enough for more NEW QE immediately.http://www.zerohedge.com/news/june-non-farm-payrolls-come-80000-misses-expectations-unemployment-rate-82

I am not sure where the market goes. I will think of add equity around 1320.

Tuesday, July 3, 2012

Plan before the close today

I am going to close my equity investment before the market close today to avoid any uncertainty on employment data. I will update my market view a little bit later

11:55 Need to leave now. Close my SPY at 137.40. Happy 7/4

11:55 Need to leave now. Close my SPY at 137.40. Happy 7/4

Wednesday, June 27, 2012

Into the Quarter end

As I discussed all the time, economy is always yelling to equity market, "It is way to fast". I am expecting QE3 or in lieu, that is something to bubble it up. Without it, we are going to do some gravity check, like the one we are in. Previously I always go long ahead of FED decision, and exit if FED failed to deliver. This is a conservative play, but I missed some profits. Not this time. I try to learn from previous experience. Maybe I should, but let's see how it works this time.

In my early June post, I put down my summer plan as a box trading, from 1290-1370 with a mid line of 1330. I will still play my plan with micro management. If it is too close to the top I will underweight, vise versa.

Here is an interesting chart from my friend Kena.

What does this chart say? It is trying to chart the relationship between market liquidity with equity index (NYA in this case). There could be chance big boys start to buy at this point. This is the quarter end. This is a Q that equities sharply underperform bonds. I am expecting equities to rally in the last week. Kena also posted another interesting chart. I am agree with it says. I don't like Obama but I think he will get reelected.

What does this chart say? It is trying to chart the relationship between market liquidity with equity index (NYA in this case). There could be chance big boys start to buy at this point. This is the quarter end. This is a Q that equities sharply underperform bonds. I am expecting equities to rally in the last week. Kena also posted another interesting chart. I am agree with it says. I don't like Obama but I think he will get reelected.

Wednesday, June 13, 2012

video from BTV - Investors Prepare For Possible U.S. Bank Downgrades

scary video, but very interesting and informative.

Friday, June 8, 2012

Charting the market

I have a tiny little bit problem in understanding the market. I cannot decide whether it will be another down leg. I add half of my equity position yesterday and plan to add another half when SPX reach 1290 again. Check the chart above for my plan.

Here is my hourly cloud chart. It is a confusing moment as quick cloud dip into slow cloud. I think 1300 area or the bottom of slow cloud should hold or it will be hard to do wave count.

Below are the 2 other charts I post frequently. Just pick whatever you like :D.

Here is my hourly cloud chart. It is a confusing moment as quick cloud dip into slow cloud. I think 1300 area or the bottom of slow cloud should hold or it will be hard to do wave count.

Below are the 2 other charts I post frequently. Just pick whatever you like :D.

Wednesday, June 6, 2012

I think it is bottomed

Overnight movement is convincing. I read the market as bottomed at 1270 area. /ES successfully took 1280 to confirm the bottom is in. I am expecting a recovery summer.

I will look for an entry point either today or tomorrow.

To add later.

I will look for an entry point either today or tomorrow.

To add later.

Friday, May 18, 2012

Hold off

Market is moving too fast and I am too busy recently. I didn't get chance to update my view when the market is at my first target of 1330.

SPX is approaching my original target around 1290 neighborhood. I expect more battle at 1300. I refine my plan to chase the market if 1300 is confirmed to be a short term bottom, but not to hold the falling knife.

When I say confirmed, I am thinking of a rebound to 1320-1325 area then back down to sub 1300 to make either a double bottom or a higher low.

SPX is approaching my original target around 1290 neighborhood. I expect more battle at 1300. I refine my plan to chase the market if 1300 is confirmed to be a short term bottom, but not to hold the falling knife.

When I say confirmed, I am thinking of a rebound to 1320-1325 area then back down to sub 1300 to make either a double bottom or a higher low.

Monday, May 7, 2012

Sell in May and walk away

The "Sell in May" strategy worked with a high success rate. I guess it works this year as well. Equity futures drop HUGE tonight, and now below the "Benanke-hint".

As expected.

The market need to "persuade" him to print more money. What really bothers me is still the correlation among products. Here are the latest reading of the over night futures market.

SPX 1342, check;

USD 80.1, check;

EURO 1.298 smile;

oil 95, wow;

gold 1638, what???

Enough said. No change in strategy. No change in plan. Good luck to all.

As expected.

The market need to "persuade" him to print more money. What really bothers me is still the correlation among products. Here are the latest reading of the over night futures market.

SPX 1342, check;

USD 80.1, check;

EURO 1.298 smile;

oil 95, wow;

gold 1638, what???

Enough said. No change in strategy. No change in plan. Good luck to all.

Sunday, April 22, 2012

Love the Earth, our mothership

Our planet, our home is being neglected. This Earth Day it's time to mobilize the planet from the ground up to send a message that the Earth won't wait!

Here are some pictures shot by Andre Kuipers, space station astronaut, from ISS. Check how beautiful it is. Hope it will be as beautiful many many years later.

http://www.telegraph.co.uk/technology/picture-galleries/9202815/Andre-Kuipers-space-station-astronaut-sends-pictures-to-Earth-via-Twitter.html?frame=2192333

Here are some pictures shot by Andre Kuipers, space station astronaut, from ISS. Check how beautiful it is. Hope it will be as beautiful many many years later.

http://www.telegraph.co.uk/technology/picture-galleries/9202815/Andre-Kuipers-space-station-astronaut-sends-pictures-to-Earth-via-Twitter.html?frame=2192333

Friday, April 13, 2012

Economy is yelling at Stock Market

I am getting a little bit lazy lately. Really I don't have much to say. The day before yesterday, Gary Shilling made a very good interview with Bloomberg TV. He said this is a liquidity driven market. The market's only focus is FED's sugar cane but not real growth. Yes you hear me right, the market is in sugar high. Fundamental is important, and it is not too great, but it is largely ignored. Economy is yelling to the stock market, don't be too fast.

With liq, it will go up; if takes away it will go down. For the days market went up, you can always find news / hint / rumor saying the FED is implying QE3. For the days market went down, it's driven by the real economy data. What the market is fear of? No real earning growth. The earning growth for SP500 corporations in Q1 is 0%, and less than 2% in Q2. The stock market is running on a double digit rally. On those major financial TV channels, you will hear "experts" saying stocks are cheap because we have very low P/E ratio. The current TTM P/E is 15-16 which is pretty low, but how sustainable it is, how organic it is. We know in extreme, P/E ratio is always lagging and always flipping even faster than stock price. Doug Short wrote:

And Doug also provided a snapshot of where we at. It is very self-explanatory. Is it cheap? NO.

I am not in the class of desperate bears. I still think US economy is recovering. I still believe FED will deliver QE3 or in lieu. They are going to make decision when the current operation twist ends in June. The market, led by GS will ask for it. It will be bumpy next couple months. I still seek to buy low. Below is my road map I posted couple days ago. ES 1385-1390 area is about 50% to 61.8% of the current down leg. I will watch it to see if the current drop is just a bigger correction or it is trend change.

My plan is too add 50% of equity exposure when SPX at 1330 area, and add another half at 1290 (the 2 beams on chart).

Add: forgot to update my portfolio. Still no change as of 3/31/2012.

Bond, Gold, Equity, REIT, USD, Emerging market all risk on. I am still overriding the equity signal and put the money in USD.

Add: A video to share, title

Buy gold, short the Euro and be prepared for the big equities sell off

With liq, it will go up; if takes away it will go down. For the days market went up, you can always find news / hint / rumor saying the FED is implying QE3. For the days market went down, it's driven by the real economy data. What the market is fear of? No real earning growth. The earning growth for SP500 corporations in Q1 is 0%, and less than 2% in Q2. The stock market is running on a double digit rally. On those major financial TV channels, you will hear "experts" saying stocks are cheap because we have very low P/E ratio. The current TTM P/E is 15-16 which is pretty low, but how sustainable it is, how organic it is. We know in extreme, P/E ratio is always lagging and always flipping even faster than stock price. Doug Short wrote:

Legendary economist and value investor Benjamin Graham noticed the same bizarre P/E behavior during the Roaring Twenties and subsequent market crash. Graham collaborated with David Dodd to devise a more accurate way to calculate the market's value, which they discussed in their 1934 classic book, Security Analysis. They attributed the illogical P/E ratios to temporary and sometimes extreme fluctuations in the business cycle. Their solution was to divide the price by a multi-year average of earnings and suggested 5, 7 or 10-years. In recent years, Yale professor Robert Shiller, the author of Irrational Exuberance, has reintroduced the concept to a wider audience of investors and has selected the 10-year average of "real" (inflation-adjusted) earnings as the denominator. As the accompanying chart illustrates, this ratio closely tracks the real (inflation-adjusted) price of the S&P Composite. The historic average is 16.4. Shiller refers to this ratio as the Cyclically Adjusted Price Earnings Ratio, abbreviated as CAPE, or the more precise P/E10, which is my preferred abbreviation.

And Doug also provided a snapshot of where we at. It is very self-explanatory. Is it cheap? NO.

I am not in the class of desperate bears. I still think US economy is recovering. I still believe FED will deliver QE3 or in lieu. They are going to make decision when the current operation twist ends in June. The market, led by GS will ask for it. It will be bumpy next couple months. I still seek to buy low. Below is my road map I posted couple days ago. ES 1385-1390 area is about 50% to 61.8% of the current down leg. I will watch it to see if the current drop is just a bigger correction or it is trend change.

My plan is too add 50% of equity exposure when SPX at 1330 area, and add another half at 1290 (the 2 beams on chart).

Add: forgot to update my portfolio. Still no change as of 3/31/2012.

Bond, Gold, Equity, REIT, USD, Emerging market all risk on. I am still overriding the equity signal and put the money in USD.

Add: A video to share, title

Buy gold, short the Euro and be prepared for the big equities sell off

Wednesday, March 7, 2012

Still bullish on GOLD

Save money for college tuition? Ben Bernanke said his son, who is in medical school in New York, is likely to rack up $400,000 of student loan debt in the process of getting his degree. In the same meeting, Ron Paul also shot a silver bullet to the vampire. Ben said you can have silver but it's just not US currency.

The chart below explains how to save for college tuition. Ben should know that before sending his son to school.

We are not in Gold or precious metal standard. That's true. Ben keeps on lying about inflation (per Ron Paul). That one needs your own judgement. The chart says save tuition in Gold anyway.

Here is some more reading on Supply Demand and others from Morgan Stanley via Zero Hedge.

I have to admit I am a fan of CNBC's Maria Bartiromo. When I was watching her, I found this. It is a must for all serious and prudent investor. Jim Grant is the editor of Grant's Interest Rate Observer.

The chart below explains how to save for college tuition. Ben should know that before sending his son to school.

We are not in Gold or precious metal standard. That's true. Ben keeps on lying about inflation (per Ron Paul). That one needs your own judgement. The chart says save tuition in Gold anyway.

Here is some more reading on Supply Demand and others from Morgan Stanley via Zero Hedge.

Stay Long Gold

Jim says the FED is manipulating the market to achieve desirable macro outcome. The FED is dulling the market sensors of risk in the entire marketplace, by pressing the interest rate. The FED should learn the lesson from 1920-21 depression. (and don't forget 1929 and 1930s right after.) Then comes the classic conversation:

Maria Bartiromo: "What are the alternatives?"

Jim Grant: "Capitalism is an alternative for what we have now. I highly recommend it."

Maria: "We all do."

Grant: "No we don't."

Maria: "The Federal Reserve may not."

Grant: "We ought to be discussing an intelligent move to a sound currency by which i mean a currency that is based on a standard and not at the whim and the discretion of a bunch of mandarins sitting around Washington D.C."

Tuesday, March 6, 2012

Marc Faber on CNBC

Monday 3/5, Marc was on CNBC discussing how an investor should allocate his or her portfolio in the face of a stock market correction he thinks is coming in the short term. After today's crazy market drop, we now have a better understanding.

He also said, "I think investors misunderstand what is risk , I think it is highly risky to have all your money in cash, if I did not have anything today , I will invest right away little bit in equities little bit into properties and little bit into gold and accumulate every month."

He perfectly explained it. In this market, we need to own something. There is risk owning 100% cash or T-products. Refer to LMP series for my approach.

He also said, "I think investors misunderstand what is risk , I think it is highly risky to have all your money in cash, if I did not have anything today , I will invest right away little bit in equities little bit into properties and little bit into gold and accumulate every month."

He perfectly explained it. In this market, we need to own something. There is risk owning 100% cash or T-products. Refer to LMP series for my approach.

Monday, March 5, 2012

Low Maintenance Portfolio - Mar 2012

There are lots of things happening on me recently. I am couple days late this month. No big change in view. No big deal, I think.

For the new month, I have everything on buy side.

In summary, my holdings are (at initial weight when first invested):

20% Emerging Market (DEM)

20% Gold (GLD)

20% Real Estate (VNQ)

20% Bond (LTPZ)

20% USD (UUP)

In the first 2 months, my return is 3.5% as of 3/1/2012. The benchmark data are below:

Forward looking:

Everything on buy signal is a bad sign. In a normal market, US Dollar and US Treasury products have negative correlation with US Equities. We are not seeing that. Dow is at a psychological point of 13,000. Keep on trying and keep on being rejected. We will see a resolution soon. As I mentioned couple times, this is not a market that I can comfortably holding longs. I will stay away from US equity until I feel comfortable.

There is some problem with Gold last week. FED said no further QE on 2/29. We saw a huge intraday drop of 90 bucks (over 5%)! After the drop, now GLD is getting closer to the MA, but still with good cushion. I am still bullish on Gold, but I will follow system. If the support at GLD 162 breaks, I will exit and move to DBC which also turned bullish.

For the new month, I have everything on buy side.

The 5 IVY portfolio components are

- SP 500 (Risk ON) (override)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk ON) / USD (Risk ON)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON)/ GLD (Risk ON)

In summary, my holdings are (at initial weight when first invested):

20% Emerging Market (DEM)

20% Gold (GLD)

20% Real Estate (VNQ)

20% Bond (LTPZ)

20% USD (UUP)

In the first 2 months, my return is 3.5% as of 3/1/2012. The benchmark data are below:

| 12/30/2011 | 3/1/2012 | |||

| TLT / (Bond) | 121.25 | 116.22 | -4% | |

| SPY / (Equity) | 125.5 | 136.75 | 9% | |

| Percentage | ||||

| BOND | 100.00% | 60.00% | 40.00% | 0.00% |

| EQUITY | 0.00% | 40.00% | 60.00% | 100.00% |

| 100.00% | 100.00% | 100.00% | 100.00% | |

| Return | ||||

| BOND | -4.15% | -2.49% | -1.66% | 0.00% |

| EQUITY | 0.00% | 3.59% | 5.38% | 8.96% |

| -4.15% | 1.10% | 3.72% | 8.96% |

Forward looking:

Everything on buy signal is a bad sign. In a normal market, US Dollar and US Treasury products have negative correlation with US Equities. We are not seeing that. Dow is at a psychological point of 13,000. Keep on trying and keep on being rejected. We will see a resolution soon. As I mentioned couple times, this is not a market that I can comfortably holding longs. I will stay away from US equity until I feel comfortable.

There is some problem with Gold last week. FED said no further QE on 2/29. We saw a huge intraday drop of 90 bucks (over 5%)! After the drop, now GLD is getting closer to the MA, but still with good cushion. I am still bullish on Gold, but I will follow system. If the support at GLD 162 breaks, I will exit and move to DBC which also turned bullish.

Thursday, February 23, 2012

Dow Theory, Volume, Correction, The Year ahead

Update on Dow Theory. Somebody posted a research paper on the Dow Theory the other day. In short it says Dow Jones Industrial and Transportation index need to confirm each other. We are in one of the largest (if not the largest, be conservative) divergence at this moment. DJIA is going higher. 13K level has only been seen in 2007 (and early 2008) in history. How about DJT? It is going lower since the beginning of this month, and it is still pretty far away from the highs. In fact it is below the 50 day moving average.

Why will this happen? I am seeking answer too. I guess it is because of the EURO crisis. Lots of money managers either in Europe or with international orientation are relocating to manage risk. Econ data are not too bad to exit equity, while currency risk is getting higher. They moved their investments to US equity. This explanation could also explain Dow 30 is always leading. DJIA (large 30) > SPX (large 500) > WLSH. In a uncertain market, large cap help to preserve value. DJIA is so well know that if in hurry, people just go long these names. I observe name stock outperform as well. Apple is a big winner. Per the annual meeting material this morning, there are 216 funds holding AAPL shares.

In general this rally is not a typical one that I want to participate. The euro crisis broke lots of correlation. The market is getting low degree of predictability. In history if a divergence occurred, a correction to due. Usually it is to the down side.

Where the correction could be? Last night Doug Kass made an interview with CNBC. He is calling for a 5-6% correction. My calculation, it is 1300. They also discussed the missing volume. Pete says it's option market holding more vol. Instead of selling the stocks they are holding, people buying puts to hedge. Evidence, yesterday 1m spy puts were bot.

ZH reports, "Following Abysmal 2011, Only 10% Of Hedge Funds Are Outperforming The S&P In 2012"

As we discussed, the first month of 2012 is another dumb bull market. It is not easy to beat market if you are doing active management. 2009 is a good example for us. What's the famous word again? Buy the F...ing Dip (btfd). Lots of money managers missed 1330 to now. I guess they are herding to buy badly if there is any correction. I think Kass' number makes sense. My plan is to turn on DCA once we see the correction.

ADD: 1 thing need to know about Doug

Doug Kass is probably the last trader to be a bear. In late Dec he called for SPX all time high in 2nd half of 2012. I forgot his number, but definitely over 1520. After the past 2 months, I guess people are getting more serious about this call.

Why will this happen? I am seeking answer too. I guess it is because of the EURO crisis. Lots of money managers either in Europe or with international orientation are relocating to manage risk. Econ data are not too bad to exit equity, while currency risk is getting higher. They moved their investments to US equity. This explanation could also explain Dow 30 is always leading. DJIA (large 30) > SPX (large 500) > WLSH. In a uncertain market, large cap help to preserve value. DJIA is so well know that if in hurry, people just go long these names. I observe name stock outperform as well. Apple is a big winner. Per the annual meeting material this morning, there are 216 funds holding AAPL shares.

In general this rally is not a typical one that I want to participate. The euro crisis broke lots of correlation. The market is getting low degree of predictability. In history if a divergence occurred, a correction to due. Usually it is to the down side.

Where the correction could be? Last night Doug Kass made an interview with CNBC. He is calling for a 5-6% correction. My calculation, it is 1300. They also discussed the missing volume. Pete says it's option market holding more vol. Instead of selling the stocks they are holding, people buying puts to hedge. Evidence, yesterday 1m spy puts were bot.

ZH reports, "Following Abysmal 2011, Only 10% Of Hedge Funds Are Outperforming The S&P In 2012"

As we discussed, the first month of 2012 is another dumb bull market. It is not easy to beat market if you are doing active management. 2009 is a good example for us. What's the famous word again? Buy the F...ing Dip (btfd). Lots of money managers missed 1330 to now. I guess they are herding to buy badly if there is any correction. I think Kass' number makes sense. My plan is to turn on DCA once we see the correction.

ADD: 1 thing need to know about Doug

Doug Kass is probably the last trader to be a bear. In late Dec he called for SPX all time high in 2nd half of 2012. I forgot his number, but definitely over 1520. After the past 2 months, I guess people are getting more serious about this call.

Wednesday, February 22, 2012

Simplicity is the ultimate sophistication. - da Vinci

Me a long term da Vinci fan. See my other post on that.

Today I saw this video on long term investments. I think it makes sense, and it is in line with my view on long term gold and monetary market.

Speaker of the video is Grant Williams, manager of Vulpes Investment Management based in Singarpore. He is also the author of "Things to make you say hmmm'.

Part 2

Today I saw this video on long term investments. I think it makes sense, and it is in line with my view on long term gold and monetary market.

Speaker of the video is Grant Williams, manager of Vulpes Investment Management based in Singarpore. He is also the author of "Things to make you say hmmm'.

Part 2

Subscribe to:

Comments (Atom)