I read this article from the big picture.

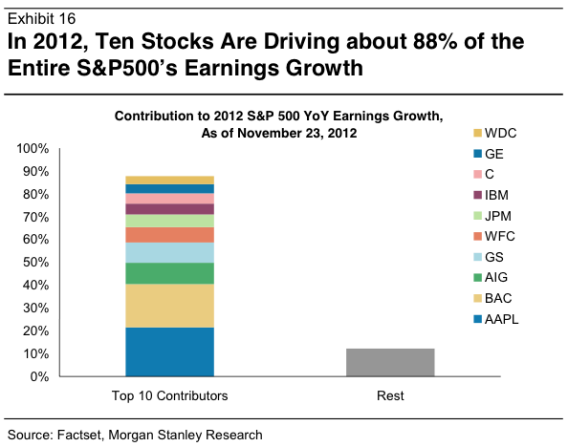

4 Companies Provided Half of SPX 2012 Earnings Growth

It notes that nearly 90% of this year’s earnings growth of the S&P 500 companies can be traced to 2% or 10 companies.Who are they? All those too big to fall names. Yeah.

There seems to be two industries, finance and technology. It is even more concentrated than the chart suggests. Four

companies–three financial services (AIG, Goldman and Bank of America)

and one technology firm (Apple) provided over half of the earnings

growth of the S&P 500.

If the next door papamama grocery grows slower than its banker, what does it suggest? Go figure.

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

December Low Indicator

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

No comments:

Post a Comment