Mayan calendar said the world should be ended 6am this morning. I think it is. The old world is gone. We are in a brand new world now. It's just you don't feel it. I think I rescue the whole world all by myself. You know I am superman / batman kind. :D

For those who don't use ES, lucky you. SPX currently is at 1430, -5 from yesterday's close. However, ES, the futures of SPX dip to 1391 last night, a 1% drop on the political combat.

I am on my mission to rescue the US now. I will solve the fiscal problem.

Here is the bullish Gartley that is going to protect us for now.

Friday, December 21, 2012

Thursday, December 20, 2012

world end? another waiting mode

The world didn't end according to Kathy Lien who is in NZ. The local time there is 3am 12/21/2012.

Yesterday I laid out my support line at 1430. So far it holds, but we are still in questionable zone of 1430-36. Here is the chart update.

I saw people shorting the market then covered after the eco news. Philly Fed at 8.1!! Existing home sales +5.9%.

What's next? I don't know. Let's just hold and hope.

ADD:

This is the interview on Santa Stock Surge. Bespoke's Paul Hickey appeared on CNBC's Street Signs today to discuss the Santa Claus Rally.

Some key points:

- santa rally starts 21 to year end.

- 12/30 has been the best day with 0.51% gain on average from 1928 to 2011

- In the ten days from 12/21 through year end, the S&P 500 has averaged gains on nine out of ten days for an average total gain of 1.82%.

Today ES closed at 1440.75.With 1.82% extra gain, it will end up at 1467 which is a very close to the 1468 yearly top. Does this mean we are not going any higher or it will be a double top pattern? I don't know. Paul mentioned another important data that historically Dec gain is about 2.1-2.2%. We already up about 2% as of today. Will we see a 4% month or just flat for the rest of the year? I have plans for both scenario. Let's wait and see.

Yesterday I laid out my support line at 1430. So far it holds, but we are still in questionable zone of 1430-36. Here is the chart update.

I saw people shorting the market then covered after the eco news. Philly Fed at 8.1!! Existing home sales +5.9%.

What's next? I don't know. Let's just hold and hope.

ADD:

This is the interview on Santa Stock Surge. Bespoke's Paul Hickey appeared on CNBC's Street Signs today to discuss the Santa Claus Rally.

Some key points:

- santa rally starts 21 to year end.

- 12/30 has been the best day with 0.51% gain on average from 1928 to 2011

- In the ten days from 12/21 through year end, the S&P 500 has averaged gains on nine out of ten days for an average total gain of 1.82%.

Today ES closed at 1440.75.With 1.82% extra gain, it will end up at 1467 which is a very close to the 1468 yearly top. Does this mean we are not going any higher or it will be a double top pattern? I don't know. Paul mentioned another important data that historically Dec gain is about 2.1-2.2%. We already up about 2% as of today. Will we see a 4% month or just flat for the rest of the year? I have plans for both scenario. Let's wait and see.

Wednesday, December 19, 2012

I think it is still uptrend. Levels to watch ES 1436-1430

Dow and S&P 500 really starting to fade after the crazy yesterday. S&P 500 has now given up more than half of its gain from yesterday. I am guessing it is still uptrend, but I want to watch 1436 and 1430 levels for safety. If 1430 cannot hold, I will stop myself out.

I will be on vacation next week. As usual, I don't want to keep positions open.

ADD:

I saw the following charts from the corner.

Even though we share very similar view on couple stocks, I have to tell Serge, his taste of woman is not so great. :D

ADD again.

Well this one gets better:

I will be on vacation next week. As usual, I don't want to keep positions open.

ADD:

I saw the following charts from the corner.

Even though we share very similar view on couple stocks, I have to tell Serge, his taste of woman is not so great. :D

ADD again.

Well this one gets better:

Friday, December 14, 2012

Gangnam Style - Certain Things to avoid

Here is news on Gangnam Style Dance.

In order to prove I am not middle-aged yet, I think I should try the list above. I tried Gangnam style dance for about 2 minutes and I feel dizzy. After this news I decide to quit that crap, forever. Me no sporty-car type, but rather off-road kind. I don't want to change my style, at least for now. I am losing hair. Still better than my friend COB, but I don't think I want to do hair in a can. The only left-over is to date an illegal hottie. I am on my way to NYC. Let's see if I can do that. :D

The market is dancing in a way hard to predict. FED meeting is making it worse. I bot some options to protect my position and disclosed in last post. As planned I closed that hedge yesterday at sub-1420 level. Now we are all the same. Holding long positions, naked, and watching market falling. This is another I don't know moment. I guess and I hope 1407 will hold.

(Starting from now, I am using Mar 2013 ES, which is about 5 points below SPX.)

There are certain things that middle-aged men should probably steer clear of: buying a flashy sports car, dating a barely-legal hottie, succumbing to the allure of hair-in-a-can.

However, this week, after the death of a British dad, experts now warn that dancing "Gangnam Style" may be yet another middle age no-no.

As the Sun notes, 46-year-old Eamonn Kilbride was performing the energetic dance -- made wildly famous by Korean pop star Psy -- at his office Christmas party over the weekend when he suddenly collapsed and died.

In order to prove I am not middle-aged yet, I think I should try the list above. I tried Gangnam style dance for about 2 minutes and I feel dizzy. After this news I decide to quit that crap, forever. Me no sporty-car type, but rather off-road kind. I don't want to change my style, at least for now. I am losing hair. Still better than my friend COB, but I don't think I want to do hair in a can. The only left-over is to date an illegal hottie. I am on my way to NYC. Let's see if I can do that. :D

The market is dancing in a way hard to predict. FED meeting is making it worse. I bot some options to protect my position and disclosed in last post. As planned I closed that hedge yesterday at sub-1420 level. Now we are all the same. Holding long positions, naked, and watching market falling. This is another I don't know moment. I guess and I hope 1407 will hold.

(Starting from now, I am using Mar 2013 ES, which is about 5 points below SPX.)

Tuesday, December 11, 2012

Quick update

I was looking for a dip to 1400 then a rally to 1430 in my monthly LMP update. So far I got both of them. Not sure what's next. I feel a pull back to 1420 area then for next move. I am using derivatives to play that. It is small, so long term investors don't have to take that action.

Monday, December 3, 2012

Monday morning news reading

I read this article from the big picture.

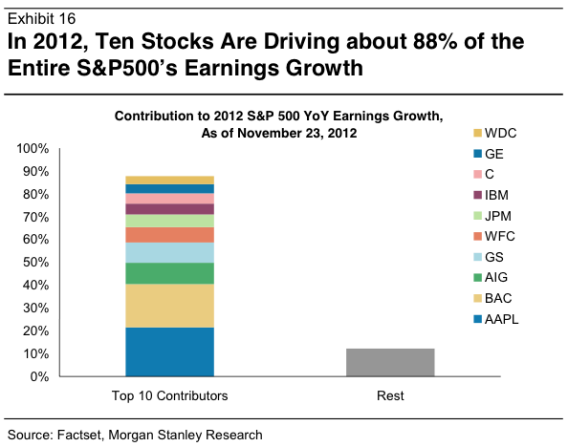

4 Companies Provided Half of SPX 2012 Earnings Growth

It notes that nearly 90% of this year’s earnings growth of the S&P 500 companies can be traced to 2% or 10 companies.Who are they? All those too big to fall names. Yeah.

There seems to be two industries, finance and technology. It is even more concentrated than the chart suggests. Four

companies–three financial services (AIG, Goldman and Bank of America)

and one technology firm (Apple) provided over half of the earnings

growth of the S&P 500.

If the next door papamama grocery grows slower than its banker, what does it suggest? Go figure.

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

December Low Indicator

Here is another one. Pure data analysis. Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s, noted that the trend could be random or even manipulated during a holiday season. If that low is violated during the first quarter of the New Year, it is frequently an excellent warning sign. In the link, 60 years of data were presented. It works 17 out 31.

More interestingly, I found it a prove to Jan Barometer as well. JB failed 6 times, out of 60 years history from 1950 to 2010. A 90% successful rate! 3 of the fails occurred in the last decade. All 6 occurred in YEARS DOW FELL BELOW DECEMBER LOW IN FIRST QUARTER.

Sunday, December 2, 2012

Low Maintenance Portfolio Update Dec 2012

No big change in view. No big deal, I think.

For the new month, I have everything on buy side.

What's different this month is I am holding 20% of SPY (It's the ETF for SP 500. It is 1/10 of SPX plus dividends) at 136 for 2 weeks now (refer to my 3-push pattern posts). This month, SPX actually dip below the MA then came back to form a hammer shape. To add at the signal line is not a violation to the LMP methodology.

I think it may face some short-term pressure. I am managing the risk by using some simple derivative strategy. I hope it could go up a little bit more, let's say 143ish.

My plan is holding equity for Santa, then close out before Christmas.

For the new month, I have everything on buy side.

The 5 IVY portfolio components are

- SP 500 (Risk ON)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk ON) / USD (Risk ON)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON)/ GLD (Risk ON)

- US Dollars (Risk off)

What's different this month is I am holding 20% of SPY (It's the ETF for SP 500. It is 1/10 of SPX plus dividends) at 136 for 2 weeks now (refer to my 3-push pattern posts). This month, SPX actually dip below the MA then came back to form a hammer shape. To add at the signal line is not a violation to the LMP methodology.

I think it may face some short-term pressure. I am managing the risk by using some simple derivative strategy. I hope it could go up a little bit more, let's say 143ish.

My plan is holding equity for Santa, then close out before Christmas.

Subscribe to:

Comments (Atom)