As I mentioned earlier, I love NFLX. I cannot live without. :D

After I closed my long term position in late 2010, I am still trading it. My feeling is just one part. I am a pretty technical person. I only trade the signals.

Today, NFLX recorded a typical pattern to yell for a short. (Well, it's actually this morning that I missed.)

Not sure what pattern to call for. Island reversal? Bearish Flag? Whatever.

The bottom line is the gap will be touched if not fully filled.

We will do the same routine to define our trading plan.

The pattern will be off for any close above 217.5.

I believe it is trigered already today by a close below 211. The only thing is Bears are in such a hurry and Bulls are not that easy to give up. Hope we can get a retest to 210 level to fill my order.

See ya in the 180s.

Monday, February 28, 2011

Thursday, February 24, 2011

Market may bounce from now

2 days! The Bear just need 2 days to eat everything above 1300. Back early January when I say Bull trap above 1310, even I don't give too much credit to my own prediction. lol

Now where are we? Broken. The daily chart is broken. The key points to watch remain the same. See my earlier post. I believe this is P3. Repeat,the P3 started.

On intraday chart, the wave structure is also easy and clear. The past days draw 2 downside channels. They both demanding a bounce. The blue scenario is going to form a head & shoulder bottom. The golden one will form a 3 push pattern. Both of them are pointing at 1325. Will they break 1325? Guess not. Check how many times this zone got hit in the past? It is a very good quality resistance now.

A lot to go. A lot to see. Since VIX is shooting up, the trader's market is coming back. Enjoy, people.

Now where are we? Broken. The daily chart is broken. The key points to watch remain the same. See my earlier post. I believe this is P3. Repeat,the P3 started.

On intraday chart, the wave structure is also easy and clear. The past days draw 2 downside channels. They both demanding a bounce. The blue scenario is going to form a head & shoulder bottom. The golden one will form a 3 push pattern. Both of them are pointing at 1325. Will they break 1325? Guess not. Check how many times this zone got hit in the past? It is a very good quality resistance now.

A lot to go. A lot to see. Since VIX is shooting up, the trader's market is coming back. Enjoy, people.

Thursday, February 17, 2011

2/17

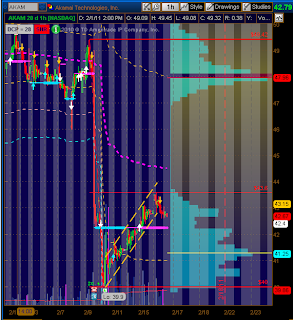

Follow up on AKAM. So far so good. On hour chart I read a clear rejection at 43.6 level. I am kinda thinking a channel break out. Somebody says after hour should not count. Let's wait and see then.

Today I want to add 1 more chart. I mean to check out LNG for a possible rumor play. By mistake I landed on LNN. Like the chart. Another short setup? Am i bearish now? Well I don't know. :D

Today I want to add 1 more chart. I mean to check out LNG for a possible rumor play. By mistake I landed on LNN. Like the chart. Another short setup? Am i bearish now? Well I don't know. :D

Tuesday, February 15, 2011

AKAM - a flag to breakout

Akamai Technologies, Inc. provides services for the delivery of content and business processes over the Internet for businesses, government agencies, and other enterprises. It offers services and solutions for content and application delivery, application performance services, on demand managed services, and business performance management services based on its technological platform, EdgePlatform.

AKAM @ Yahoo Finance | AKAM Option @ Yahoo Finance

AKAM issued earnings on 2/10 and got hammered. The daily chart explained why I bet on the low side on ER.

In the past couple days, it is crawling up, on Ericsson (ERIC) news and probably also because of Cramer's pump.

I, however, don't buy it. I see a potential bearish flag forming. The setup will become active on a breakdown below the bottom of the pattern at $41.88. If the pattern becomes active, downside potential for the pattern is to the $36.5 area, then possibly $30.

AKAM @ Yahoo Finance | AKAM Option @ Yahoo Finance

AKAM issued earnings on 2/10 and got hammered. The daily chart explained why I bet on the low side on ER.

In the past couple days, it is crawling up, on Ericsson (ERIC) news and probably also because of Cramer's pump.

I, however, don't buy it. I see a potential bearish flag forming. The setup will become active on a breakdown below the bottom of the pattern at $41.88. If the pattern becomes active, downside potential for the pattern is to the $36.5 area, then possibly $30.

Thursday, February 10, 2011

my baby NFLX

NFLX is my baby. I found it since 2007. Use it, love it, invested in it. I closed my position late 2010 since it reached my valuation target of 200. This earning season, I estimated 2011EPS to be $4.60 and with an average multiplier of 46.6x observed for the past 3 years, I gave NFLX a target of 210-220.

Today I noted Whitney Tilson's T2 capitulated on NFLX shorts. Below are the extracts from the letter.

In mid-December, we published a lengthy article on why Netflix was our largest bearish bet at the time. With the stock up nearly 25% since then, one might assume that we’d think it’s an even better short today, but in fact we have closed out our position because we are no longer confident that our investment thesis is correct.

1) The company reported a very strong quarter that weakened key pillars of our investment thesis, especially as it relates to margins;

2) We conducted a survey, completed by more than 500 Netflix subscribers, that showed significantly higher satisfaction with and usage of Netflix’s streaming service than we anticipated (the results of our survey are in Appendix A, attached); and

3) Our article generated a great deal of feedback, including an open letter from Netflix’s CEO, Reed Hastings, some of which caused us to question a number of our assumptions.

In summary, while we acknowledged in our December article that Netflix “offers a useful, attractivelypriced service to customers, is growing like wildfire, is very well managed, and has a strong balance sheet,” we now believe that it is an even better business than we gave it credit for. The company has enormous momentum and substantial optionality (for example, international growth), and management is executing superbly. In particular, we tip our hat to Reed Hastings, whom we had the pleasure of meeting last weekend. In addition to his success building the business and navigating the transition from DVD-by-mail to streaming media, he’s also one of the most down-to-earth, honest and straightforward CEOs we’ve ever encountered.

Based on the data provided in the T2 letter, I upgrade my target of NFLX to 235.

Today I noted Whitney Tilson's T2 capitulated on NFLX shorts. Below are the extracts from the letter.

In mid-December, we published a lengthy article on why Netflix was our largest bearish bet at the time. With the stock up nearly 25% since then, one might assume that we’d think it’s an even better short today, but in fact we have closed out our position because we are no longer confident that our investment thesis is correct.

1) The company reported a very strong quarter that weakened key pillars of our investment thesis, especially as it relates to margins;

2) We conducted a survey, completed by more than 500 Netflix subscribers, that showed significantly higher satisfaction with and usage of Netflix’s streaming service than we anticipated (the results of our survey are in Appendix A, attached); and

3) Our article generated a great deal of feedback, including an open letter from Netflix’s CEO, Reed Hastings, some of which caused us to question a number of our assumptions.

In summary, while we acknowledged in our December article that Netflix “offers a useful, attractivelypriced service to customers, is growing like wildfire, is very well managed, and has a strong balance sheet,” we now believe that it is an even better business than we gave it credit for. The company has enormous momentum and substantial optionality (for example, international growth), and management is executing superbly. In particular, we tip our hat to Reed Hastings, whom we had the pleasure of meeting last weekend. In addition to his success building the business and navigating the transition from DVD-by-mail to streaming media, he’s also one of the most down-to-earth, honest and straightforward CEOs we’ve ever encountered.

Based on the data provided in the T2 letter, I upgrade my target of NFLX to 235.

Monday, February 7, 2011

Key Levels to watch

The Market is rallying on below average volume and extreme sentiment. How long will it last? Bernanke may not know either.

Subscribe to:

Comments (Atom)