| AMATEURS | PROFESSIONALS |

| Have tons of ideas, are excited about all of them and see none to fruition. | Have tons of ideas, pick one and do their best to make it happen. |

| Think they can do everything. | Know it’s almost impossible to achieve one thing. |

| Think they know everything. | Are always learning. |

| Start with no preparation. | Do research, they want to know where the bodies are buried, what the landscape holds. Better to take all these factors into account before you start, because trying to adjust on the fly is so much more difficult, it wastes time and energy and it’s hard to put a fourth wheel on a car you designed with three. |

| Don’t finish. | Are all about execution. Sure, they occasionally abandon a project when they see further effort is fruitless, but the mark of a pro is someone who begins and ends. If you notice someone can’t complete a task, run from them! |

| Are worried about image. | Let their work do the talking. |

| Demonstrate insecurity. | Are extremely confident. |

| Can only see what’s in front of them. | Are all about the big picture. |

| Hold those above them in contempt. | Hold no one in contempt, but they haven’t got much time for losers. If you’re an amateur trying to graduate to professional status and you have the good fortune to encounter a pro, DON’T WASTE THEIR TIME! Give just one or two compliments and ask your question. But most amateurs are so busy being sycophants the professional tunes out, or goes on at such length that the professional excuses himself. |

| Have no idea what dues are. | Have paid their dues, and are still paying them. |

| Believe in instant success. | Know anything worth accomplishing takes a long time, and what might look like overnight success is rarely such. |

| Boast. | Never slap their own backs, and are oftentimes uncomfortable with others slapping their backs. |

| Get nervous. | May be anxious, but they’ve performed the task so many times they let instinct take over, they go on their experience, nervousness never comes into the equation. |

| Are looking for their one big break. | Know that life is about a series of breaks. |

| Are afraid to fail. | Don’t like to fail, but when they do they pick themselves up, dust themselves off and get back in the game. |

| Interrupt. | Listen. |

| Demonstrate their bile, they get frustrated or angry and it’s easy to see. | Are cool, calm and collected. You may read about the crazy owner/operator/entrepreneur, but if they’re truly nuts, they don’t last, their board replaces them, and the truth is most are not that nuts, it just makes a better story in the press to portray them as such. |

| Bristle. | Show empathy. |

| Are always telling you how busy they are and how hard they’re working. | Show up and stay as long as it’s interesting and profitable, bitching gains them nothing, so they don’t. |

| Believe what people say. | Believe what people do. |

Saturday, May 3, 2014

weekend for fun

Thursday, May 1, 2014

Wednesday, April 23, 2014

reading list

This is the mid-of month catch all. I will put ideas, readings and charts together here.

The pattern itself has a pretty big range. I marked 3 possible areas for pull back target. I am going to trade the range 1810-1875 (or 1800-1900 to be safe) for now. Again this is not a long term sell signal yet. If you really want to know what I do, pm me for discussion.

While stocks are prone to boom and bust cycles, experts say a well balanced portfolio is the best way to grow wealth over a long period of time."Investing over period of years in diverse portfolio is the pathway to financial stability,"

Tape reading

This is a chart I cut this morning. I read it as a bearish crab. In other words, unless we get some super power to take out the previous all-time high 1892.75, it will check the gravity. Recently with the momentum stock sell-off, new tech, bio, solar, and other hot names are all coming back from peak. Before the market finds new motion, I really cannot see a new high.The pattern itself has a pretty big range. I marked 3 possible areas for pull back target. I am going to trade the range 1810-1875 (or 1800-1900 to be safe) for now. Again this is not a long term sell signal yet. If you really want to know what I do, pm me for discussion.

Interesting Stats

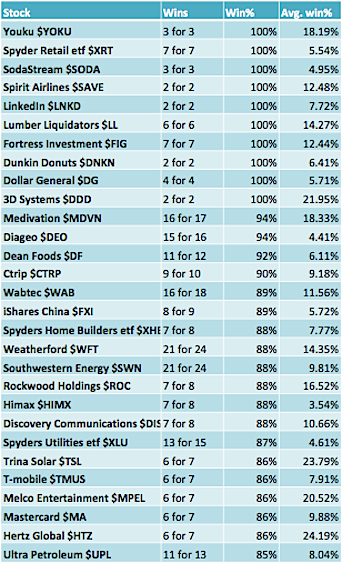

I found this from bespoke.com

From this table, we can see Tuesday is really bullish. Actually this table starts from this year. Per my count, Of the 17 Tuesdays since Dec 24th 15 have been up and only 2 down. Also Tuesdays account for 8.68% which is also impressive. Tuesday and Thursday are positive, the other 3 are on average negative. Go figure.

Goldman's forecast

With all of that in mind, here are Goldman Sachs' current forecasts for

the U.S. economy and every major financial asset class in the world. It

comes from David Kostin's new US Weekly Kickstart note.

Other readings

In spite of these challenges, investment strategies have tried to benefit from such inefficiencies. The two most common approaches investors have used are to wager that the macro inefficiency will continue to magnify or that it will revert. The first is a momentum or trend-following exposure while the latter is a contrarian or reversion exposure. As mentioned earlier, both these approaches need patience, ample reserves and nerves of steel.

Americans still don't trust the stock market

The survey of over 1,000 households by Bankrate.com showed that 73% are "not more inclined to invest in stocks.While stocks are prone to boom and bust cycles, experts say a well balanced portfolio is the best way to grow wealth over a long period of time."Investing over period of years in diverse portfolio is the pathway to financial stability,"

THE “STOCK PICKER’S MARKET” FALLACY

Overall, most investors would do well to ignore the allure of “stock picking” and any notion that they have an innate ability to pick winning stocks. I know this may be hard to accept but it should be somewhat easier when you look at the performance of most institutional stock pickers who suffer from the same behavioral foibles. This is not to say that it is impossible pick winning stocks as there are certainly great stock pickers in existence. However, the casual investor with no process or strategy is highly unlikely to be among them. It is never a “stock picker’s market” for these investors.

Fortunately, though, stock picking is not a prerequisite to successful investing. In fact, it is the antithesis of successful investing for many. For most investors, instead of “doing their homework” in trying to find the next Google or Apple, they should be developing an appropriate asset allocation plan and sticking to it. While not as exciting as jumping aboard the latest 3D printing or biotech breakout, it is likely to be significantly more profitable in the long run.

Monday, April 7, 2014

bottoming or not

Today ES, the SP500 futures draw a quick bottom around 1833 which happened to be 3/27 low. So far I believe it is bottomed for now. IMO, it is a good quality 1on1, pointing at high 1850s. On the chart I listed couple supporting levels.

The next chart is silver daily. As I mentioned last time, I am playing the Gartley reversal. My target is still 21.50

Thursday, April 3, 2014

LMP March 2014

The 5 portfolio components signals are

In the charts below, the lighter color Moving Average is 200 Day, which is very close to the IVY Portfolio setup. This month is trick as couple charts need further consideration.

- SP 500 (Risk ON)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk off)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON) / GLD (Risk off)

- US Dollars / UUP (Risk off)

In the charts below, the lighter color Moving Average is 200 Day, which is very close to the IVY Portfolio setup. This month is trick as couple charts need further consideration.

1. SPY

I truly believe 2014 will be a stock picker's market. Overall economy will recover and getting better. Overall stock market performance will not be as crazy as last year. Again, it is time to forget Beta and searching for Alpha. As a result, I will still looking for individual stocks to invest, rather than park in SPY, the SP500 ETF. I will post a chart of my view on SPY/SPX/ES later. Basically I think there is a small correction due right in front of the historic high on ES. Job report this Friday could be a trigger for that.

According to STA, April is the best month for equities. Here is a review of March sectors:

Here is a list of stocks showing strong seasonality in April.

A couple of items worth noting: Energy names Weatherford (WFT) and Southwestern (SWN) have produced positive gains in 21 out of 24 occurrences in the month of April. The average win% for Weatherford has been 14.35% and 9.81% for Southwestern – now that’s some strong April seasonality! As well, the Retail Index (XRT) has not had a losing April in its young history (7 ofr 7).

Here is the link

2. DEM / EEM

The crisis in Ukraine continues to be fought on the diplomatic and public relations fronts. Russia

continues to station 40,000 troops on the Ukranian border. Meanwhile, Russian Foreign Minister

Sergey Lavrov is on record as saying, “We have absolutely no intention of, or interest in, crossing

Ukraine’s borders.”

Emerging market is recovering and just took the 200MA as I mentioned in my last post. I went in using option combos on EEM. The trend change is largely led by Turkey and Brasil. I am looking for stocks too. Below is a list of countries I like and the ETF ticker:

Vietnam (VNM), Thailand (THD), Indonesia (EIDO),

Turkey (TUR), Poland (EPOL),

Brazil (EWZ), Colombia (GXG) and Mexico (EWW).

I also think frontier markets (FM) continue to make sense, particularly for those seeking portfolio diversification. Another attractive way to play emerging markets is with the bonds; the most liquid of which are the PCY and EMB ETFs.

3. TLT

I'm out of bonds for couple months. Even though it is now very close to buy signal, I decide not to take it. I park my money at some "bond" like equities, such as Private Equity and Mortgage Servicer and Insurance Companies. Another alternative can be municipal funds. I need time to explore that area.

4. Real Estate

No major change other than I moved some capital into some stocks such as builders and investors.

5. Commodity

Still risk on, but the price action is weakened by strong dollar. Not sure how long it will be. I am in favor of energy and agricultural stocks. I also think gold miners may get a chance. I will post my charts later.

I continue to favor long positions in corn (CORN) and agriculture (DBA). I also like being short crude oil (USO) and continue to favor a short position in natural gas (UNG).

Wednesday, March 26, 2014

quick update - EEM SLV

The world is uneasy in the past couple weeks. The market is volatile. My view is "the short term market is weak but not enough to trigger mid- to long- term sell."

EEM is the ETF for emerging market. After the Ukraine crisis cool off a little, it is rebounding. I see a good year for the emerging market. I expect high 41s in short term.

SLV is the ETF for silver. I have been trading silver for couple months. I have a neutral position at this moment because there are lots of uncertainties in the metal market. It is OK to say IDK from time to time. I am Long term bullish. I modify my position when a buy is triggered which could be very soon.

Tuesday, February 18, 2014

reduce exposure

V shape again. No matter how much I love it, I feel ES / SPX is getting close to a stopping point. I reduced my exposure today. Overall my target is still 1880. I want to buy at 1815. There is chance ES break out 1850 directly w/o correction. If it happens, I will chase.

Subscribe to:

Posts (Atom)