- SP 500 (Risk ON)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk off)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON) / GLD (Risk off)

- US Dollars / UUP (Risk off)

In the charts below, the lighter color Moving Average is 200 Day, which is very close to the IVY Portfolio setup. This month is trick as couple charts need further consideration.

1. SPY

I truly believe 2014 will be a stock picker's market. Overall economy will recover and getting better. Overall stock market performance will not be as crazy as last year. Again, it is time to forget Beta and searching for Alpha. As a result, I will still looking for individual stocks to invest, rather than park in SPY, the SP500 ETF. I will post a chart of my view on SPY/SPX/ES later. Basically I think there is a small correction due right in front of the historic high on ES. Job report this Friday could be a trigger for that.

According to STA, April is the best month for equities. Here is a review of March sectors:

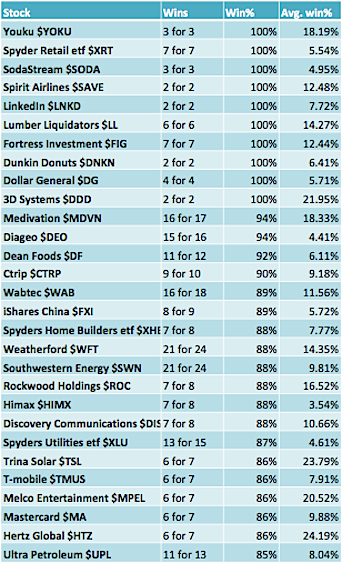

Here is a list of stocks showing strong seasonality in April.

A couple of items worth noting: Energy names Weatherford (WFT) and Southwestern (SWN) have produced positive gains in 21 out of 24 occurrences in the month of April. The average win% for Weatherford has been 14.35% and 9.81% for Southwestern – now that’s some strong April seasonality! As well, the Retail Index (XRT) has not had a losing April in its young history (7 ofr 7).

Here is the link

2. DEM / EEM

The crisis in Ukraine continues to be fought on the diplomatic and public relations fronts. Russia

continues to station 40,000 troops on the Ukranian border. Meanwhile, Russian Foreign Minister

Sergey Lavrov is on record as saying, “We have absolutely no intention of, or interest in, crossing

Ukraine’s borders.”

Emerging market is recovering and just took the 200MA as I mentioned in my last post. I went in using option combos on EEM. The trend change is largely led by Turkey and Brasil. I am looking for stocks too. Below is a list of countries I like and the ETF ticker:

Vietnam (VNM), Thailand (THD), Indonesia (EIDO),

Turkey (TUR), Poland (EPOL),

Brazil (EWZ), Colombia (GXG) and Mexico (EWW).

I also think frontier markets (FM) continue to make sense, particularly for those seeking portfolio diversification. Another attractive way to play emerging markets is with the bonds; the most liquid of which are the PCY and EMB ETFs.

3. TLT

I'm out of bonds for couple months. Even though it is now very close to buy signal, I decide not to take it. I park my money at some "bond" like equities, such as Private Equity and Mortgage Servicer and Insurance Companies. Another alternative can be municipal funds. I need time to explore that area.

4. Real Estate

No major change other than I moved some capital into some stocks such as builders and investors.

5. Commodity

Still risk on, but the price action is weakened by strong dollar. Not sure how long it will be. I am in favor of energy and agricultural stocks. I also think gold miners may get a chance. I will post my charts later.

I continue to favor long positions in corn (CORN) and agriculture (DBA). I also like being short crude oil (USO) and continue to favor a short position in natural gas (UNG).

No comments:

Post a Comment