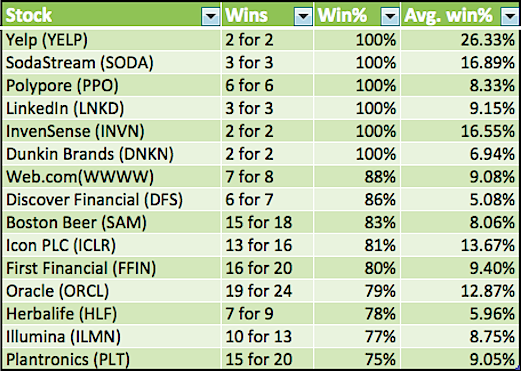

bullish stocks

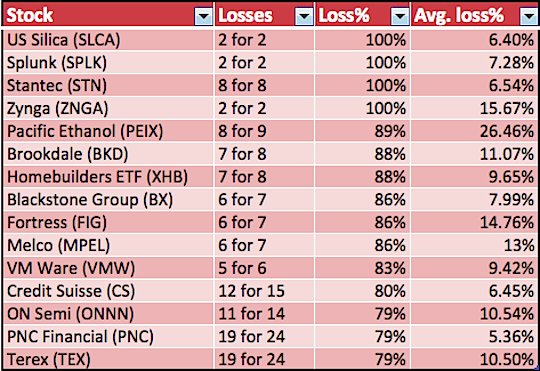

Bearish Stocks

Friday, June 6, 2014

Tuesday, June 3, 2014

Bet into earnings

I want to show another way of using options. Earnings release is a typical event trading topic. Every company has to release earnings 4 times in a year. At ER, company is going to summarize previous quarter and provide forward looking statement. Frequently it becomes a catalyst to stock price movement.

Stock selection

Graham Valuation Model

Benjamin Graham is a legendary stock writer from last century. Overall, Graham taught us the philosophy behind valuing a company and investing, while Buffett has shown an example of how to apply Graham’s knowledge and has taught us how to be more critical of management.

- Fundamental analysis

By using the info provided by the above website, I selected this stock JOY.

From google:

Joy Global Inc. manufactures and services mining equipment for the extraction of coal, copper, iron ore, oil sands, gold, and other minerals.

- Sector analysis

In general, the entire mining machinery sector is going to be benefit from the improving China PMI.

China’s slight improvement in their main manufacturing PMI to 50.8 from 50.4 for May just puts it back to its 2013 average of 50.8 but as we all fear a pronounced China slowdown, the markets are taking the news positively. Export orders and employment remained below 50 but new orders rose to a 6 month high. China has taken some modest stimulus steps and are now afraid of slowing the property market too much as housing restrictions have been eased and selective reserve requirement ratios have been lowered. China’s markets were closed overnight but copper is up by almost 1.5%.JOY as one of the most shorted stock could be Primed for a Short Squeeze

- Technical analysis

Here is the link showing the TA of the stock.

- Analyst opinion

Zack is an analyst site I follow. They think the earning could be great.Option Combo

I opened a calendar spread. That is short Jun 60 call and long July 60 call. I need the stock to go up but not too much. My sweet spot is 60.Monday, June 2, 2014

LMP June 2014

The 5 portfolio components signals are

In the charts below, the lighter color Moving Average is 200 Day, which is very close to the IVY Portfolio setup.

- SP 500 (Risk ON)

- MSCI EAFE (The Most Famous International Index) (Risk ON)

- U.S. 10-Year Government Bonds (Risk ON)

- NAREIT (U.S. Real Estate Index) (Risk ON)

- SP GSCI (Goldman Sachs Commodity Index) (Risk ON) / GLD (Risk off)

- US Dollars / UUP (Risk off)

In the charts below, the lighter color Moving Average is 200 Day, which is very close to the IVY Portfolio setup.

This month I really have nothing to talk about. I posted my

charts in twitter such as this one. No change to my view.

I have limited exposure at this moment. I use covered calls

to hedge my long position. I discussed this topic couple times. Refer to my

covered call page for details.

I also sold puts related to VIX products. Any spike in VIX

will be time for me harvest.

Subscribe to:

Comments (Atom)