Tape reading

This is a chart I cut this morning. I read it as a bearish crab. In other words, unless we get some super power to take out the previous all-time high 1892.75, it will check the gravity. Recently with the momentum stock sell-off, new tech, bio, solar, and other hot names are all coming back from peak. Before the market finds new motion, I really cannot see a new high.The pattern itself has a pretty big range. I marked 3 possible areas for pull back target. I am going to trade the range 1810-1875 (or 1800-1900 to be safe) for now. Again this is not a long term sell signal yet. If you really want to know what I do, pm me for discussion.

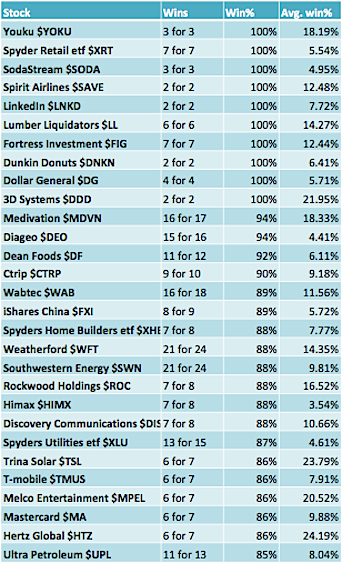

Interesting Stats

I found this from bespoke.com

From this table, we can see Tuesday is really bullish. Actually this table starts from this year. Per my count, Of the 17 Tuesdays since Dec 24th 15 have been up and only 2 down. Also Tuesdays account for 8.68% which is also impressive. Tuesday and Thursday are positive, the other 3 are on average negative. Go figure.

Goldman's forecast

With all of that in mind, here are Goldman Sachs' current forecasts for

the U.S. economy and every major financial asset class in the world. It

comes from David Kostin's new US Weekly Kickstart note.

Other readings

In spite of these challenges, investment strategies have tried to benefit from such inefficiencies. The two most common approaches investors have used are to wager that the macro inefficiency will continue to magnify or that it will revert. The first is a momentum or trend-following exposure while the latter is a contrarian or reversion exposure. As mentioned earlier, both these approaches need patience, ample reserves and nerves of steel.

Americans still don't trust the stock market

The survey of over 1,000 households by Bankrate.com showed that 73% are "not more inclined to invest in stocks.While stocks are prone to boom and bust cycles, experts say a well balanced portfolio is the best way to grow wealth over a long period of time."Investing over period of years in diverse portfolio is the pathway to financial stability,"

THE “STOCK PICKER’S MARKET” FALLACY

Overall, most investors would do well to ignore the allure of “stock picking” and any notion that they have an innate ability to pick winning stocks. I know this may be hard to accept but it should be somewhat easier when you look at the performance of most institutional stock pickers who suffer from the same behavioral foibles. This is not to say that it is impossible pick winning stocks as there are certainly great stock pickers in existence. However, the casual investor with no process or strategy is highly unlikely to be among them. It is never a “stock picker’s market” for these investors.

Fortunately, though, stock picking is not a prerequisite to successful investing. In fact, it is the antithesis of successful investing for many. For most investors, instead of “doing their homework” in trying to find the next Google or Apple, they should be developing an appropriate asset allocation plan and sticking to it. While not as exciting as jumping aboard the latest 3D printing or biotech breakout, it is likely to be significantly more profitable in the long run.