I have not updated the blog for a while. I really don't have too much to say. The market is a simple long.

As long as VIX is tamed, it is safe to go long. After the break out of 1750, SPX retested the area multiple times. it is now a very good support. This is the base of the bull market.

Hourly ES is less strong. Indicators are all weakening. I see 2 supports on the chart, 1775-1777 area and the upper bound of the 1750-1770 support box. There may be chance to see a minor pull back but nothing to worry about. If you are not fully long, take that as chance to add more. :)

2 more charts on Gold.

Friday, November 15, 2013

Monday, October 14, 2013

Earning Season Again

It is earning season again. It's time to lay out plans for stocks and for the overall market.

I think the broad market will stay in calm for the remainder of this week. Let DC figure out what they need to do. The government, the economy, the debtors, and all other stakeholders can live with whatever it is. If the issues are solved this week, unexpected, the market will go back to a large time frame rally mode. My price tag? 1750 maybe. This is a perfect setup for ER play, as the market impact is minimum. We can isolate beta and focus on alpha.

[add 2]

My first pick is credit cards. US consumers are buying again. They always love to buy things. Now some of them are out of job / out of office. What can they do to kill the time? Shopping.

COF – Capital One Financial - is currently scheduled to be announced after the close on Thursday, October 17, 2013.

Rumors:

Capital One Financial is a holding company whose subsidiaries provide a variety of products and services to consumers using its proprietary information-based strategy. The corporation's principal subsidiary, Capital One Bank offers credit card products. Capital One Services, Inc., another subsidiary of the corporation, provides various operating, administrative and other services to the corporation and its subsidiaries. The Consensus Estimate is for earnings of $1.75 this quarter and the whipser is for a profit of $1.84 per share.

If the number is in mid 1.8, the valuation should support an immediate price spike to 75+. The guidance will provide a better picture of the mid- to long- term target. My wild guess is 80 in 6 months.

Performance:

COF, along with much of the market, has had a very strong past couple of days and it would be natural for a short pullback. However, the fundamental trends continue to be in favor of COF in addition to the support for the entire sector by the Fed, and the move above $70 for the stock is a technical breakout that suggests any pullback that holds above $70 should be bought. That should be true here as we head into an expected earnings beat.

[add chart]

Trading plan:

I think the broad market will stay in calm for the remainder of this week. Let DC figure out what they need to do. The government, the economy, the debtors, and all other stakeholders can live with whatever it is. If the issues are solved this week, unexpected, the market will go back to a large time frame rally mode. My price tag? 1750 maybe. This is a perfect setup for ER play, as the market impact is minimum. We can isolate beta and focus on alpha.

[add 2]

My first pick is credit cards. US consumers are buying again. They always love to buy things. Now some of them are out of job / out of office. What can they do to kill the time? Shopping.

COF – Capital One Financial - is currently scheduled to be announced after the close on Thursday, October 17, 2013.

Rumors:

Capital One Financial is a holding company whose subsidiaries provide a variety of products and services to consumers using its proprietary information-based strategy. The corporation's principal subsidiary, Capital One Bank offers credit card products. Capital One Services, Inc., another subsidiary of the corporation, provides various operating, administrative and other services to the corporation and its subsidiaries. The Consensus Estimate is for earnings of $1.75 this quarter and the whipser is for a profit of $1.84 per share.

If the number is in mid 1.8, the valuation should support an immediate price spike to 75+. The guidance will provide a better picture of the mid- to long- term target. My wild guess is 80 in 6 months.

Performance:

COF, along with much of the market, has had a very strong past couple of days and it would be natural for a short pullback. However, the fundamental trends continue to be in favor of COF in addition to the support for the entire sector by the Fed, and the move above $70 for the stock is a technical breakout that suggests any pullback that holds above $70 should be bought. That should be true here as we head into an expected earnings beat.

[add chart]

Trading plan:

Monday, October 7, 2013

Searching for Alpha

The Value Investing Congress took place on September 16th & 17th in New York. It's time to review their picks and put together our own trading plans.

Here's the performance breakdown from October 3rd, 2012 until August 29th, 2013:

- 17 out of 21 picks outperformed the S&P 500

- Average performance of picks: +49%

- Performance of S&P 500 over same time frame: +13.3%

Jeff Ubben's Picks

Long Valeant Pharmaceuticals (VRX) +77.1%

Long Moody's (MCO): +44.2%

Long CBRE (CBG): +14.3%

Long Motorola Solutions (MSI): +11.7%

He also mentioned these names: Halliburton (HAL): +42.5%, Adobe (ADBE) +41%

Mick McGuire's Picks

Long Gencorp (GY): +50.5%

Long Brookfield Residential Properties (BRP): +39.6%

Long Alexander & Baldwin (ALEX): +28.7%

Alex Roepers' Picks

Long Rockwood Holdings (ROC): +34.9%

Long Energizer (ENR): +34%

Long Clariant (CLN VX): +33.9%

Long FLSmidth (FLS DC): -5.7%

Long Joy Global (JOY): -45.1%

Whitney Tilson's Picks

Long Netflix (NFLX): +409.8%

Long Howard Hughes (HHC): +46%

Long Berkshire Hathaway (BRK.A): +26.1%

Guy Gottfried's Picks

Long Canam Group (TSE:CAM): +81.2%

Long ClubLink Enterprises (TSE:CLK): +19.1%

Bob Robotti's Picks

Long Calfrac Well Services (TSE:CFW): +34.8%

These guys are pretty amazing, aren't they?

Here is the list for 2013 picks. Special thanks to Market Folly for putting all things together.

Guys, let's do it!!!

Here's the performance breakdown from October 3rd, 2012 until August 29th, 2013:

- 17 out of 21 picks outperformed the S&P 500

- Average performance of picks: +49%

- Performance of S&P 500 over same time frame: +13.3%

Jeff Ubben's Picks

Long Valeant Pharmaceuticals (VRX) +77.1%

Long Moody's (MCO): +44.2%

Long CBRE (CBG): +14.3%

Long Motorola Solutions (MSI): +11.7%

He also mentioned these names: Halliburton (HAL): +42.5%, Adobe (ADBE) +41%

Mick McGuire's Picks

Long Gencorp (GY): +50.5%

Long Brookfield Residential Properties (BRP): +39.6%

Long Alexander & Baldwin (ALEX): +28.7%

Alex Roepers' Picks

Long Rockwood Holdings (ROC): +34.9%

Long Energizer (ENR): +34%

Long Clariant (CLN VX): +33.9%

Long FLSmidth (FLS DC): -5.7%

Long Joy Global (JOY): -45.1%

Whitney Tilson's Picks

Long Netflix (NFLX): +409.8%

Long Howard Hughes (HHC): +46%

Long Berkshire Hathaway (BRK.A): +26.1%

Guy Gottfried's Picks

Long Canam Group (TSE:CAM): +81.2%

Long ClubLink Enterprises (TSE:CLK): +19.1%

Bob Robotti's Picks

Long Calfrac Well Services (TSE:CFW): +34.8%

These guys are pretty amazing, aren't they?

Here is the list for 2013 picks. Special thanks to Market Folly for putting all things together.

Guys, let's do it!!!

Value Investing Congress Notes: New York 2013

Wednesday, September 25, 2013

the Awesome Portfolio Checklist

sorry for my absence. me on road all the time.

here is a checklist i need to document. i will do some write up on it later when i get chance.

The Awesome Portfolio Checklist.pdf

here is a checklist i need to document. i will do some write up on it later when i get chance.

The Awesome Portfolio Checklist.pdf

Thursday, September 5, 2013

Stay Hedged for now

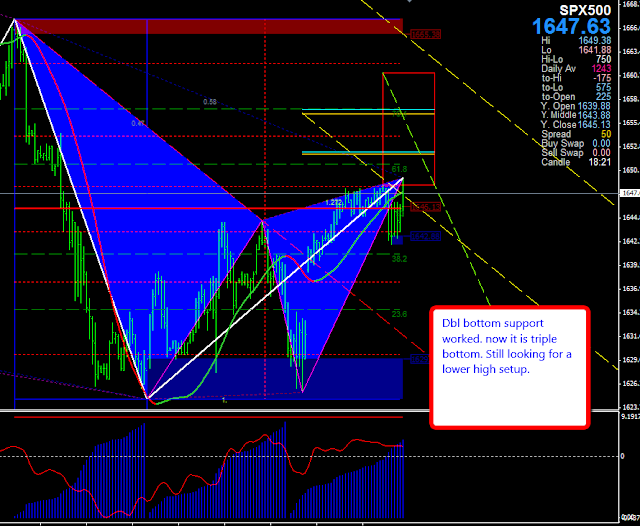

This is the update of SPX daily. As I expected, it formed a lower high and stayed at 38.2% fib level. Tomorrow we will get Employment data. Not sure what will happen, especially with tapering getting closer. It is too risky to stay in cash. I have to hold positions hedged with options and volatility ETP. Let's see how it it going.

This is the EUR hourly chart. It is a crab pattern. Statistically Crab works well.

Wednesday, September 4, 2013

Tuesday, September 3, 2013

Subscribe to:

Posts (Atom)